Hong Kong's innovation has always been at the forefront of its time. In the 1970s and 80s, it was the undisputed "uncrowned king" of Asia's IPO landscape; by the 1990s, it had become the "transaction hub" for all multinational corporations entering mainland China. Whether in times of prosperity or crisis, Hong Kong has consistently leveraged its core strengths: an efficient market, stringent regulations, and a determined competitive spirit in the financial sector. If London wrote the financial textbook and New York dominates the financial headlines, then Hong Kong is the one that actually drafts and executes the deal terms.

This history is particularly relevant today. Because every era has its own "frontier." In the past, Hong Kong's frontier was cross-border trade; later, it was China's primary trading gateway before joining the WTO; and subsequently, it became the fiercely contested Asian capital market. Each time, Hong Kong has done what it does best: finding order in chaos and transforming nascent markets into investable, scalable systems.

The crypto industry is the latest chapter in this story—ambitious, sometimes chaotic, yet brimming with powerful momentum. Once again, Hong Kong is engaging in its familiar way, leading industry progress within a compliant framework through clear regulatory guidelines and a competitive regulatory regime.

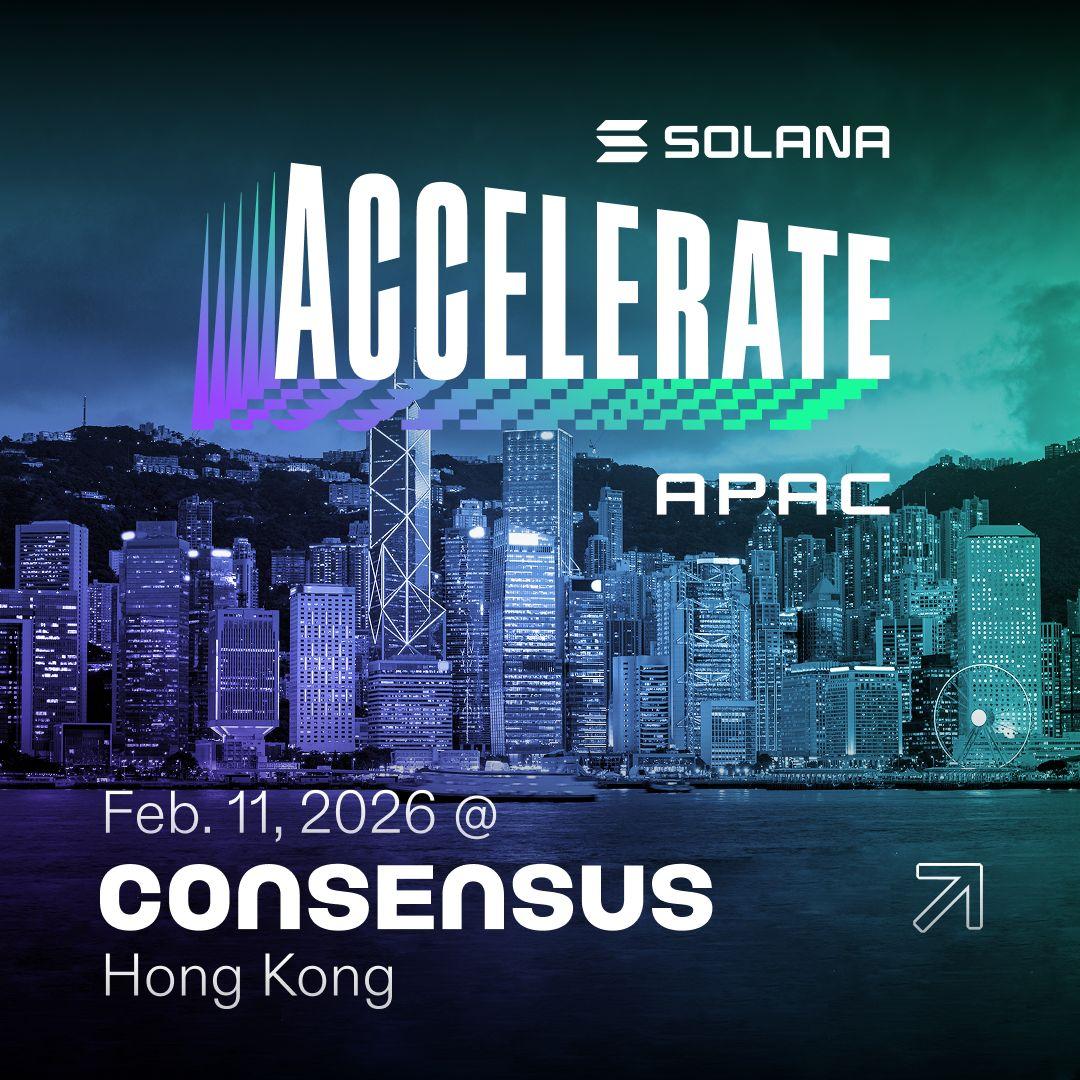

This is also why Solana Accelerate has chosen to host its event here. This year, Solana Accelerate coincides with Consensus Hong Kong, bringing together entrepreneurs, financial institutions, policymakers, and innovators. These two core events not only inject fresh vitality into the region's development momentum but also showcase to the world the future landscape of the internet capital market.